Small- to Medium-sized businesses (or, SMBs) that sell on Amazon see higher revenues on average than those that don’t.

This is partly because Amazon invests heavily in tools, resources, services, logistics, and assets that allow SMBs to succeed on the Amazon Marketplace. Let’s go over some of the ways that amazon works to spotlight the SMBs that utilize their platform:

Educational Resources

Amazon provides SMBs with programs and information to help them succeed.

Amazon Small Business Academy is a program offered by Amazon to empower SMBs. Educational tools show business owners how to expand their businesses into the digital world and reach customers globally.

The program includes various educational initiatives such as Amazon Pathways, a virtual boot camp. This provides current and potential SMB owners with the means to gain essential digital skills to remain competitive in e-commerce. The course takes place during an immersive eight-week virtual experience.

Amazon Pathways offers participants webinars with live demonstrations and expert guests. Sellers can gain important insights into selling on Amazon.

And this is only one of the initiatives from Amazon that supports SMBs.

Digital Resources

In addition to educational offerings, Amazon offers SMBs access to digital resources and tools. Amazon launched more than 135 of these in 2020 alone.

These are tools that, have proven much needed by SMBs so they can effectively maintain their physical and digital market presence.

These tools allow SMB owners to connect with their customers, and develop their e-commerce strategy.

This includes Amazon’s Black Business Accelerator program, dedicated to the growth and development of new Black-owned businesses. The program provides financial assistance, coaching, and promotional support.

Additional tools include “Repeat Purchase Behavior” which gives sellers insights into how customers engage with their brands. Thus, allowing SMBs to leverage this data to better market to them.

“Brand Follow” allows SMB sellers to connect with the customers who have shown interest in their brand through features such as personalized homepage posts.

And these are only some of the tools available through Amazon.

Amazon offers a vast array of resources that empower small businesses to leverage an abundance of data on their customers. This, in turn, gives a tremendous opportunity to grow and develop their marketing strategies.

Amazon Invests in Sellers

According to Amazon, they invested $30 billion in logistics, tools, services, and programs to promote seller growth between 2019 and 2020.

This is because independent sellers are essential to Amazon’s business model. They make up the bulk of products sold. What’s more, Amazon says SMB products make up more than 50% of all sales of their online stores.

This is why Amazon invested over $100 million to boost small businesses in 2021 to help them boost their reach and sales during Prime Day.

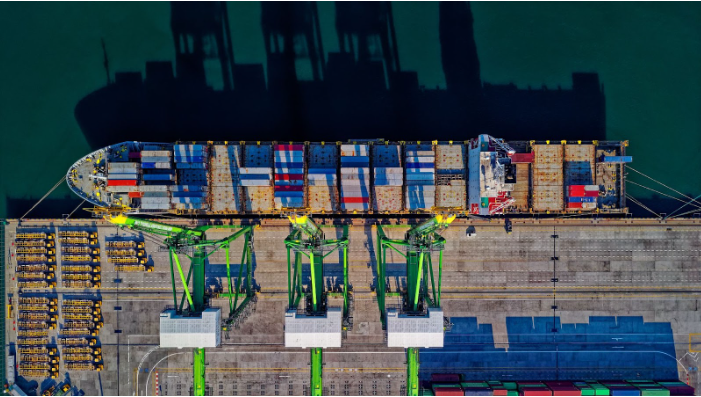

FBA Extends Small Business Reach

The biggest challenge to small businesses has always been logistics.

Amazon FBA helps small businesses solve this problem. Letting Amazon do the packing, picking, and shipping frees small businesses to focus on the work of selling and marketing their goods.

It also gives SMBs the power of Amazon’s quick delivery service. All shipping performs at the high-quality level modern buyers have come to expect. This is a feat typically unattainable for SMBs.

Leveraging FBA also equips SMBs to utilize a storage space that is otherwise not feasible for small businesses.

Amazon fulfillment centers offer an immense amount of storage for SMB products.

Access International Markets

Amazon operates out of 13 countries and ships to over 100 countries worldwide.

This offers SMBs access to a global customer base that features 200 million Prime members. By leveraging Amazon’s international logistics, any business can grow and diversify sales to include international customers from Asia to Europe.

Amazon even provides tools to help SMB sellers access these markets.

These include the Seller Central Language Switcher which enables sellers to manage operations in all Amazon marketplaces across the world in English. With this, sellers can operate internationally with a familiar interface that is easy to learn

For those interested in selling in Europe, Amazon provides a simplified method. An Amazon European stores account authorizes SMBs to create and manage products in Amazon’s online stores in Germany, the United Kingdom, France, Italy, Spain, and the Netherlands.

Conclusion

These are just some of what Amazon offers SMBs so that they can succeed and remain competitive with the big sellers.

Whether you’re a small or medium business, Amazon has a vested interest in your success. Unfortunately, even after going through all the tools and options offered, it can feel difficult to “break out” of the crowd.

That’s where we come in. The team of experts at Anata is here to guide you through the complicated world of Amazon. Contact us today for help managing your Amazon Marketplace.

The services we provide range from education to the total handling of your Amazon profile. This frees you to work on the big picture, and not stress the minutia.

We are a performance-based company. So, we don’t get paid unless you do.